Your Business, Tax Optimized

With The S.P.A.R.K. System

(Submit, Point of Clarity Call, Assessment, Results, Keystone Support)

Tax planning and advisory for small businesses.

Our Expertise, Your Solutions

Annual Compliance

Tax Preparation

With experienced professionals and a range of resources, we ensure a hassle-free tax season for individuals and businesses.

Strategic Savings

Tax Assessment

Through a personalized tax plan, we identify strategies and provide expert insights to help proactively maximize

your tax savings.

For Growing Businesses

Tax Advisory

Our advisory program assists in tax strategy implementation and provides year-round support for continuous strategizing to achieve the best results.

CEO explains the S.P.A.R.K. System

The SPARK Difference

Unlike most tax accountants, we’re not just about crunching numbers and meeting deadlines. We know each new year brings tax challenges with it – make one mistake and you’re overpaying.

We approach your taxes creatively (within the limits of course) to secure you the greatest savings imaginable, so your business can run at peak performance without getting bogged down in forms and regulations.

It’s simple.

Expert tax preparation + proactive tax planning + advisory = more money in your pocket.

Here’s how it works…

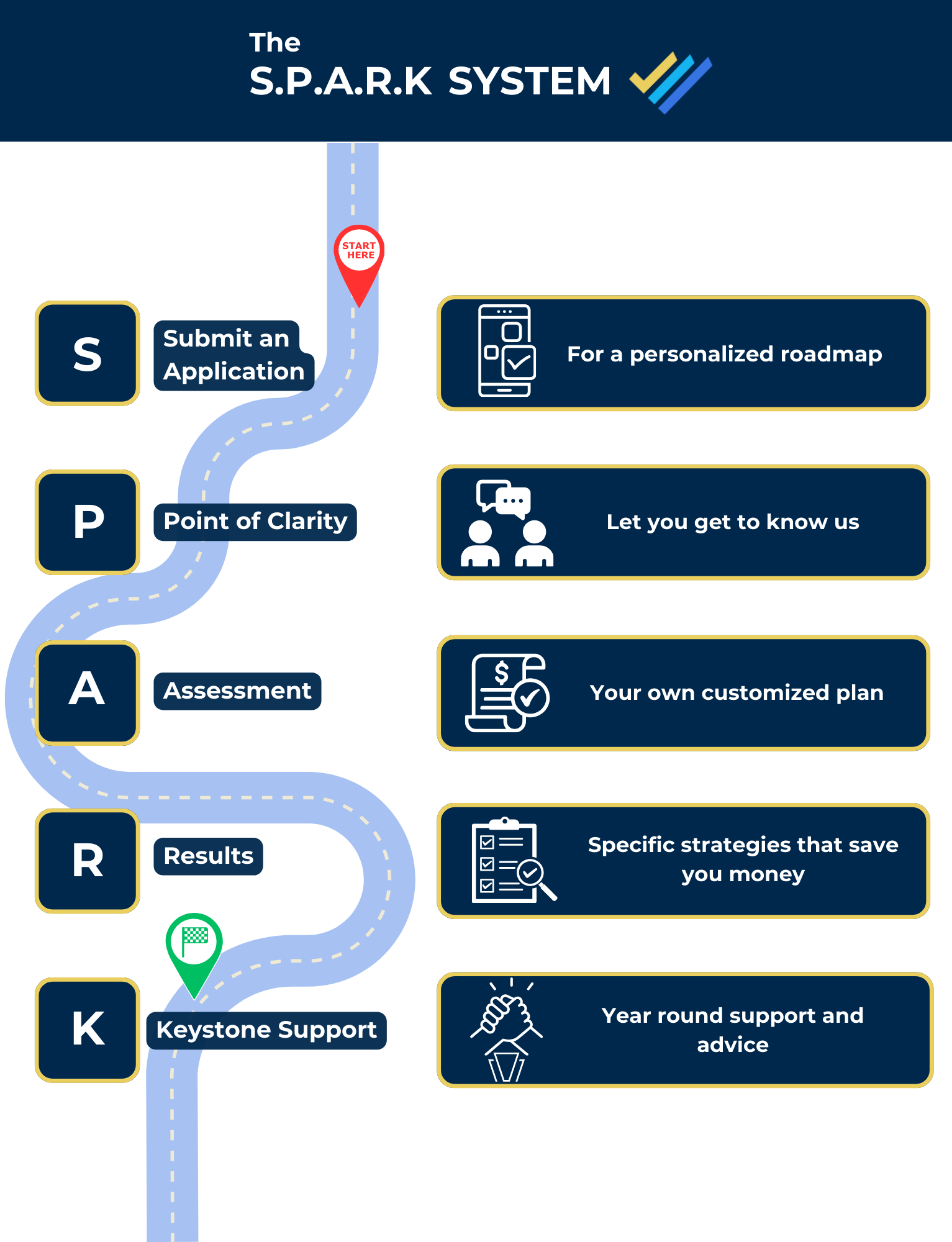

The

S.P.A.R.K SYSTEM

The Application allows us to help you build a personalized roadmap towards your tax and financial goals.

We ask in-depth questions, assess your tax health, and determine if Spark is a good fit for your business.

Our Tax Assessment finds significant savings and tax opportunities with a customized tax plan for you.

Our results presentation provides a tax plan with specific strategies to reduce your tax bill.

Our Advisory Program provides year-round support with tax prep, expert advice, and meetings to help you minimize taxes and boost profits.